Great news for All MCB customers, now with MCB Live, make hassle-free investments.

Map your existing iSAVE account and redeem instantly!

MCB Live Invest

MCB Live Invest

Want to know how?

Watch the videos below to follow the steps

Learn how to map through

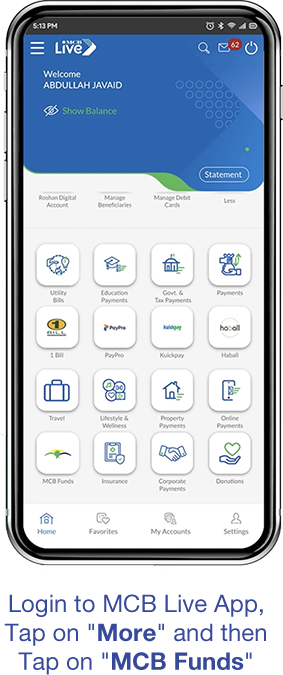

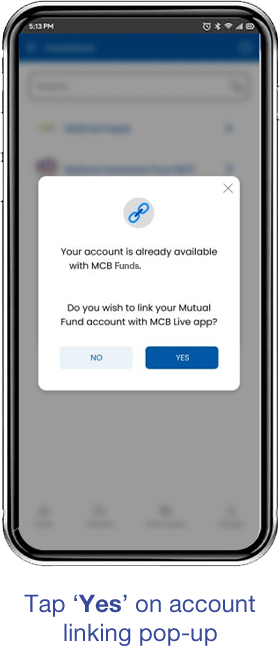

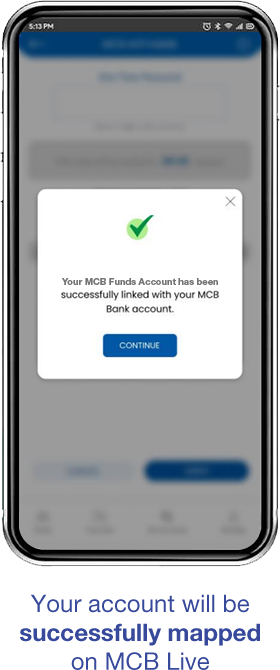

If you are an existing iSAVE customer then you just need to

map your iSAVE account with MCB live by following these steps:

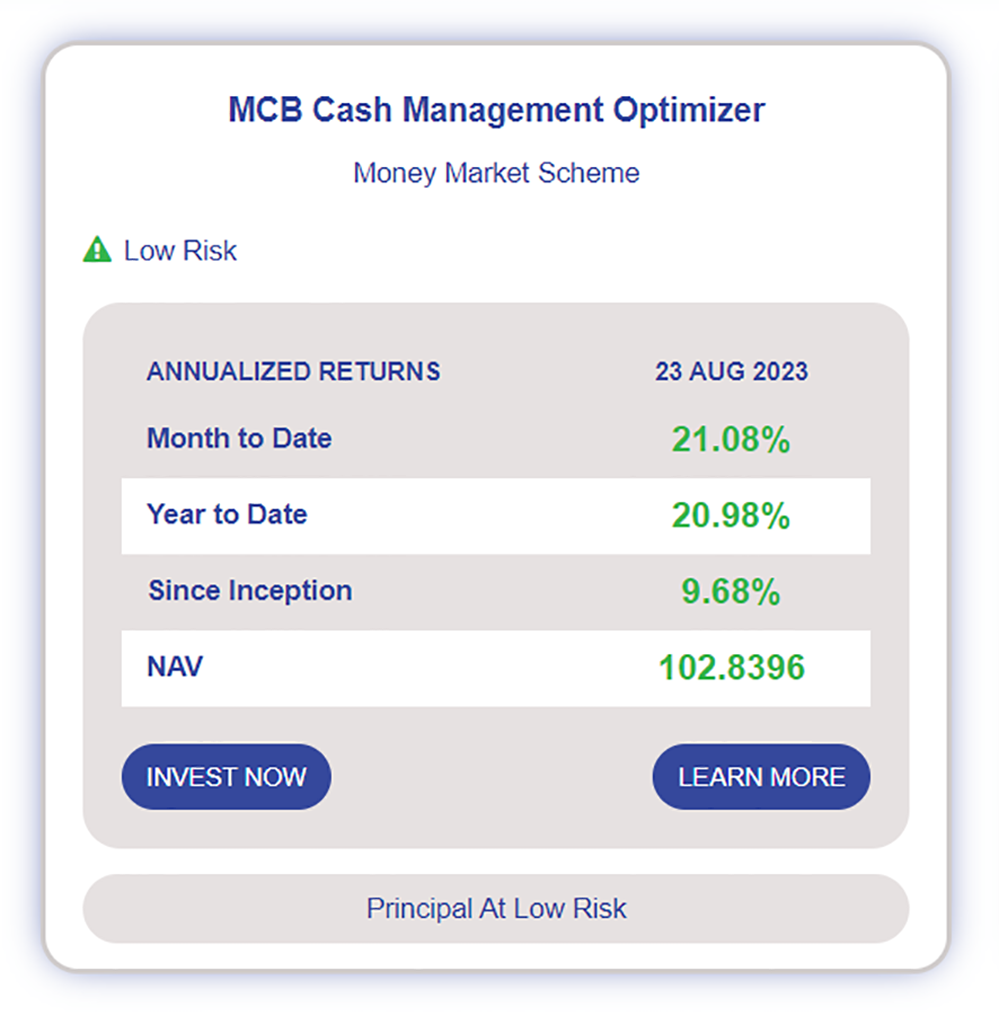

If you are a new customer and signing up on MCB Live, you will be able to see MCB Cash Management Optimizer as a default fund for investment Check the returns and past performance below:

*Calculation based on Month to Date return of MCB Cash Management Optimizer as of 31st July 2023

*Stability RatingL AA+(f) by PACRA

*MCB Cash Management Optimizer is an Open End Money Market Scheme and has risk profile of Low (Principle at Low Risk)

Disclaimer: All investments in mutual fund are subject to market risks. Past performance is not necessarily indicative of the future results. Please read the Offering Document to understand the investment policies and the risks involved.

5 year returns of MCB Cash Management Optimizer + Geometric Mean

FAQ’s

Folio number is a unique identifier assigned to an investment account and is used to track your investments with an Asset Management Company. Customer can either have a single Folio or they can also open multiple Folios as per requirement.

A Mutual Fund is a large pool of money managed by a team of experienced individuals as part of a licensed Asset Management Company. The money collected from investors is invested in securities such as stocks, bonds, money market instruments and other assets to generate returns for investors.

Mutual Funds, operated by Asset Management Companies (AMCs), are licensed by the regulator after meeting a range of requirements. A Mutual Fund is set up under a trust structure with a 3rd party entity designated as the trustee. All investments, made by the fund, bank accounts, transactions, are managed by the trustee, according to the advice of the AMC. The trustee is obligated to follow the instructions of the AMC, as long as these instructions do not violate the “Trust Deed” which is a legal agreement signed by the AMC and the trustee that governs the operating framework of the trust. (i.e. the mutual fund).

- Open-end Funds: Open-end mutual funds allow investors to invest and redeem (withdraw) their money whenever they want. They continually create new units or redeem issued units on demand and are also known as Unit Trusts. The unit holders buy the units of the fund or may redeem them on a continuous basis at the prevailing Net Asset Value (NAV). These units can be purchased and redeemed through a Management Company, which announces offer and redemption prices on a regular basis.

- Close-ended Funds: These funds have a fixed number of shares like a public company and are floated through an IPO. Once issued, they can be bought and sold at the market rates at the Stock Exchange, where they are listed at the prevailing rates at any point of time.

A fund’s Net Asset Value (NAV) represents the value per unit. The NAV is equal to the market worth of assets held in the portfolio of a Fund, minus liabilities, divided by the number of units currently issued to investors.

NAV Per Unit = (Current Market Value of all the Assets – Liabilities) / Total Number of Units Outstanding

The sales and redemption price of units might be different from the NAV if there is an element of “Sales Load / Front End Load” or “Back End Load”. The sale and redemption price is declared on a daily basis by the funds and can be viewed on their websites.

Sales Load/Front-End Load is a small service fee charged to an investor when buying or redeeming shares in a mutual fund. The fee compensates the sales team for their efforts and is mandatory to be disclosed before any payment is made.

Back-End Load is charged when customers withdraw money from funds. This is rarely used and is applied only in case of funds that have a “lock in” period. Again, it is mandatory to disclose the fee before a customer signs up for the product.

A benchmark is a standard against which the performance of a security, mutual fund or investment manager can be measured. A Mutual Fund’s performance is compared with the benchmark in order to find out whether the fund performed better than the market.

- Track your investments anytime, anywhere

- Ability to perform transactions conveniently

- Safe and secure saving in a solid institution

- Strong security measures and ensure that only you can access your information

- Paperless account opening

Yes, you can invest in as many funds as you want that are available in MCB Live application.

Yes, Zakat will be deducted unless Zakat Exemption Declaration Form (CZ-50) / Zakat Affidavit is submitted to the company. If you have your Zakat Affidavit with you and your profile says that you are not exempt from Zakat, you need to simply take a picture of the Zakat Affidavit from your phone and email it to info@mcbfunds.com with your CNIC number from your registered email address and we will take care of the rest.

You can invest for as long as you wish. However, please ensure that the fund you choose is based on how long you wish to invest and what your financial requirements and risk appetite are.

Simply login to your MCB Live application and access MCB Funds feature, hit the redeem button and choose the fund from which you wish to withdraw funds. After due process the funds would be credited in your selected MCB account.

There are certain character count limits defined for each input category, e.g. customer may enter Email address of maximum 60 characters.

A confirmation email/ SMS will be sent to the MCB Account Holder on his registered Email Address/ Mobile Number after the account is mapped successfully.

Currently, MCB Live users can only open Sehl Sarmayakari account from MCB Live application.

The limits are given below:

| Account Type | Account Title | Per Transaction Limit (Rs) | Annual Investment Limit (Rs) | Lifetime Limit (Rs) |

| Level-1 | Sehl Sarmayakari Account | 25,000 | 100,000 | 200,000 |

At the moment customer cannot upgrade their MCB Funds Sehl account from MCB Live application

Yes, all types of existing investments accounts in MCB Funds can be accessed through MCB Live application.

The account opening is instantaneous, however in case there is verification or other error MCB Funds will take 24 hours to process account

No, only Pakistani individuals can open this account

The eligibility criteria is given below:

- MCB Account Holders who are using MCB Live App/Web Portal

- Local Customers (Pakistani only)

- Individuals over and above 18 years having CNIC issued by NADRA.

- Principal Account Holder of MCB Bank Limited Only